special tax notice irs

SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS Your Rollover Options - Payments from a Section 401a Defined Benefit Plan Ed. 572 to reflect changes made by the Economic Growth and Tax Relief Reconciliation Act of 2001 EGTRRA PL.

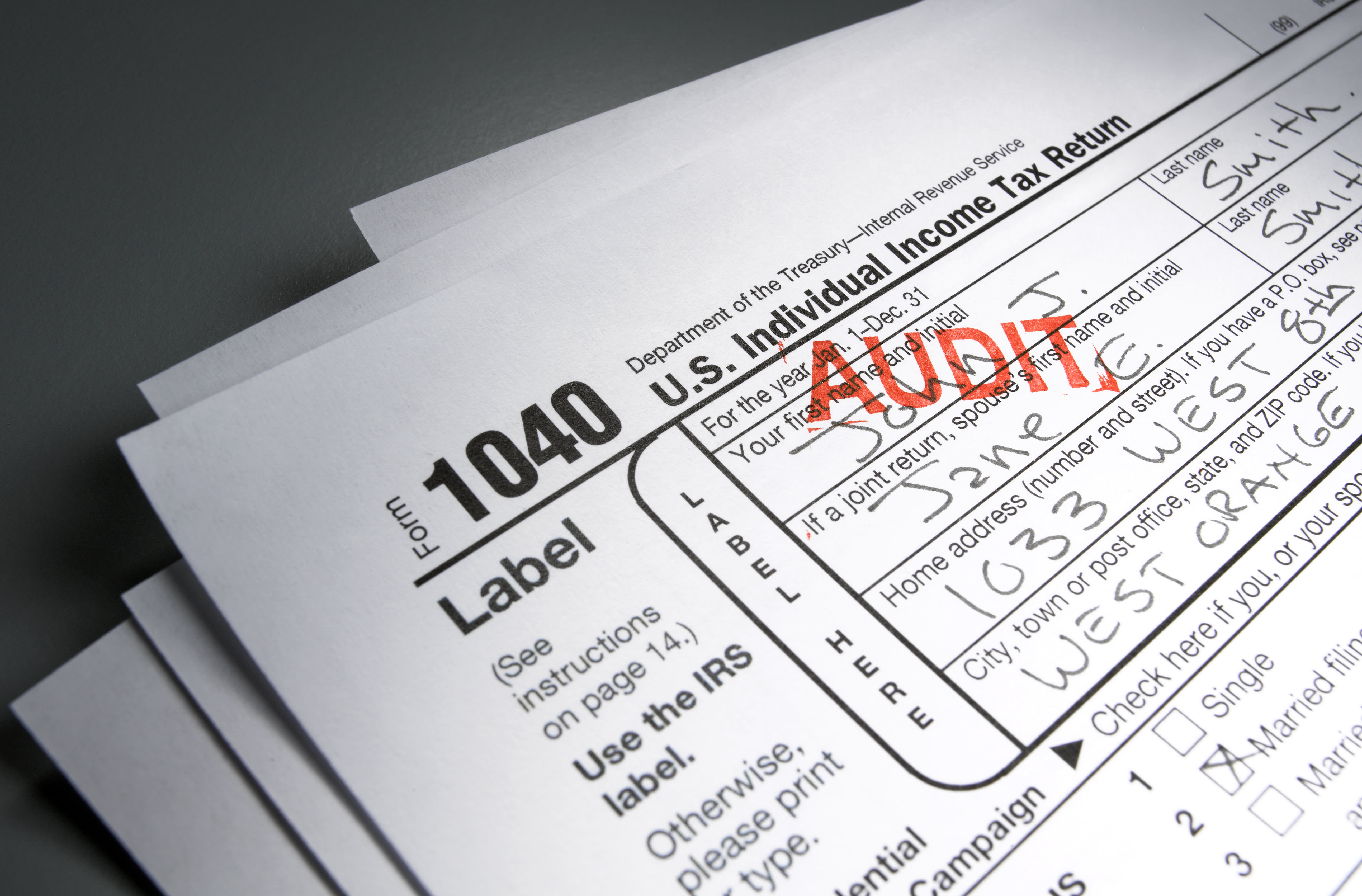

Irs Plans To Hire More Employees Here S Who It May Target For Audits

Distributions from Individual Retirement Arrangements IRAs.

. Special Tax Notice Safe Harbor Explanations Eligible Rollover Distributions. However the employee may waive the 30-day period. IRS Model Special Tax Notice Regarding Plan Payments.

If a payment is only part of your benefit an allocable portion of your after-tax contributions is generally included in the payment. After-tax contributions included in a payment are not taxed. The QOSA notice explains.

This week the IRS released new guidance updating the Special Tax Notice to include among other things changes enacted by the Tax Cuts and Jobs Act. SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS Alternative to IRS Safe Harbor Notice - For Participant This notice explains how you can continue to defer fede ral income tax on your. 12010 You are receiving this notice because all or a.

However if you receive the payment before age 59½ you may have to pay an additional. The QOSAs terms and conditions the effect of waiving the. Use the print buttons in the preview.

Special tax notice regarding plan payments. IRS Special Edition Tax Tip 201613 Beware of Fake IRS Tax. Use the print buttons in the Preview.

IRS Form 402f - Special Tax Notice. The employer must give the notice between 30-180 days before an employee receives a distribution. A9164_402f Notice 0822 3 W The exception for payments made at least annually in equal or nearly equal amounts over a specified period.

This notice announces that the Treasury Department and IRS intend to amend the final regulations under 411b5 of the Code which sets forth special rules for statutory hybrid. You are receiving this notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA. Special Tax Notice Irs.

Limited circumstances you may be able to use special tax rules that could reduce the tax you owe. The QOSA notice is given between 30 and 180 days prior to the date benefits are paid. SPECIAL TAX NOTICE YOUR ROLLOVER OPTIONS.

Was published in Notice 2000-11 2000-6 IRB. Irs model special tax notice regarding plan payments. To properly print this document hover your mouse over the document PREVIEW area.

This notice explains how you can continue to defer federal income tax on your retirement savings in your companys 401k Plan. IRS 402f Special Tax Notice VRS Defined Benefit Plans Your Rollover Options You are receiving this notice because all or a portion of a payment you are receiving from either a. And IRS Publication 571 Tax-Sheltered.

You are receivingthis notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA.

Notices Irs Rjs Law Tax Attorney San Diego California

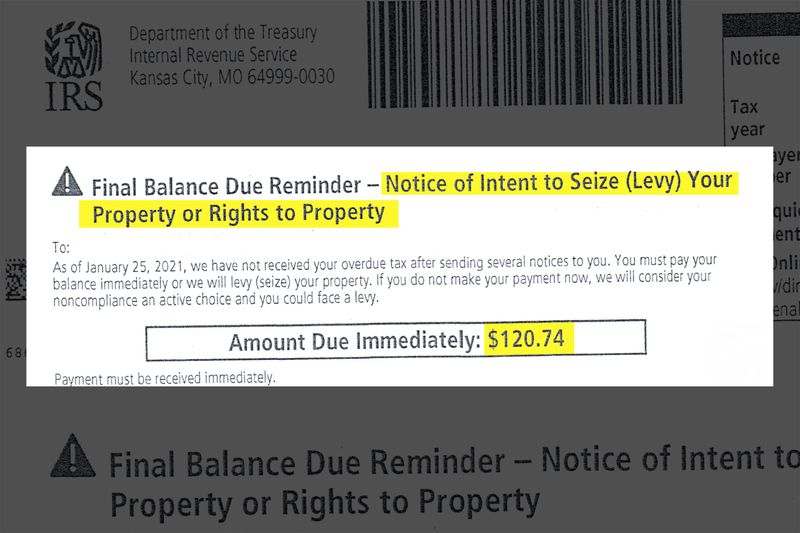

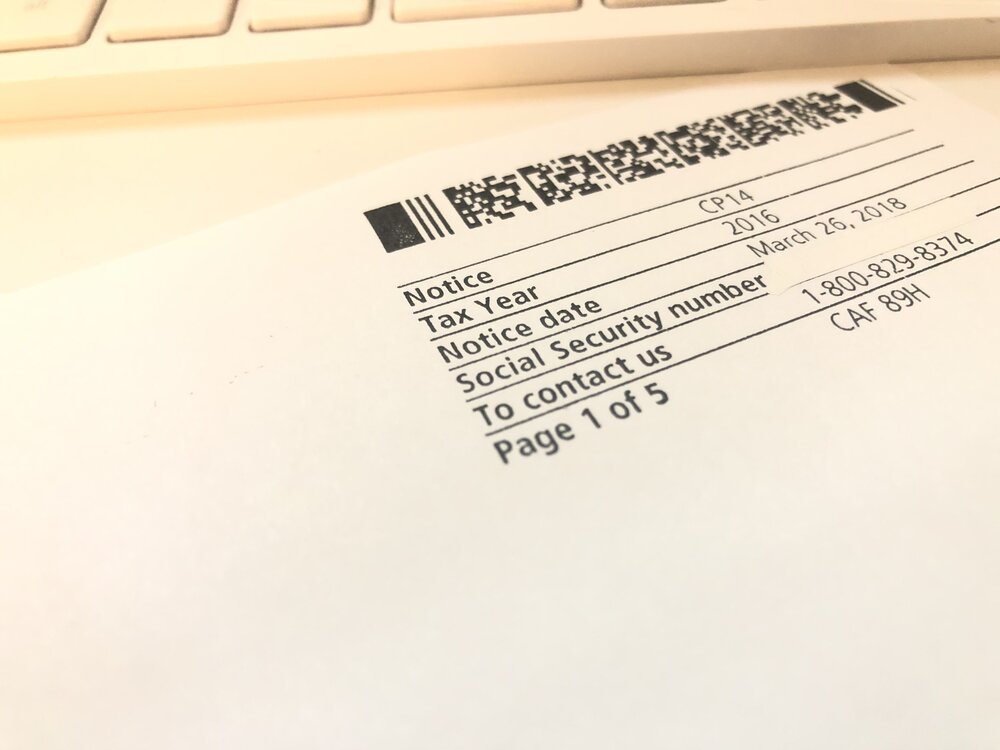

Irs Audit Letter Cp14 Sample 1

Cmk Financial Services Llc What To Do When You Get A Notice From The Irs

Irs Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

Irs Tax Notices Explained Landmark Tax Group

Responding To Irs Letters Tax Notices Alizio Law Pllc

So You Got A Letter From The Irs Kiplinger

Fake Irs Letter What To Look Out For When You Receive An Irs Letter Community Tax

The Irs Cashed Her Check Then The Late Notices Started Coming Propublica

Fake Irs Letter What To Look Out For When You Receive An Irs Letter Community Tax

What Is The Number On Your Irs Notice Milda Goeriz Attorney At Law

Irs Notices And Letters Where S My Refund Tax News Information

What Happens After You Report Tax Identity Theft To The Irs H R Block

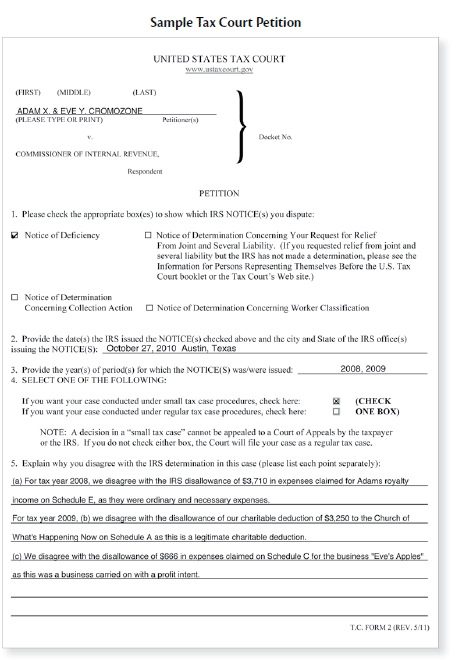

Irs Tax Court Standing Up To The Irs Law Offices Of Daily Montfort Toups

Why Did I Receive An Irs Cp14 Notice In The Mail Your Guide What To Do With The Irs Cp14 Letter Get Rid Of Tax Problems Stop Irs Collections

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition And Filing

5 Things To Know About Irs Letter 6419 Taxes And The Child Tax Credit